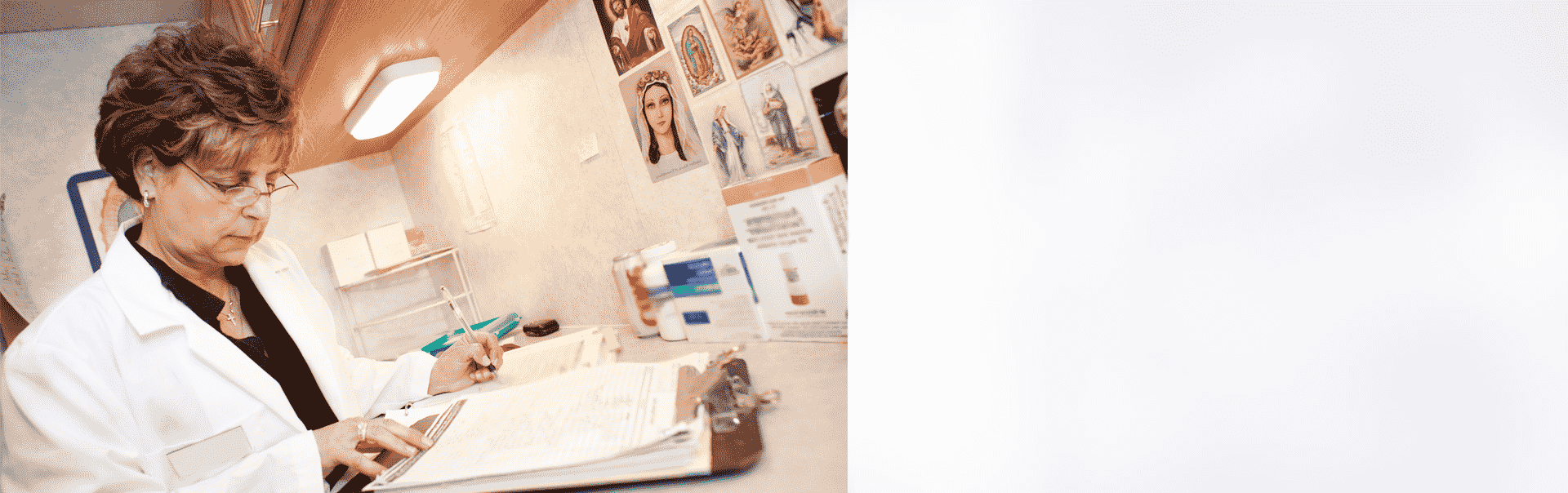

Healing Through Love

At Mission of Mercy, “Healing through Love” is primary in our mission. As we strive to heal someone – whether they are physically, spiritually, emotionally, or physically broken – we know that approaching that person with genuine Love provides at least as much healing as the physical services we provide. At Mission of Mercy, our product is Love. Our vehicle is medicine.

OUR IMPACT

Providing Care Without Barriers

since 1994

Total Number of Patients Served

0

+

Total Number of Medical Visits Provided

0

+

Nearly 30 Years of Serving

0

Testimonial

“What inspired me most is when I saw that the only clearance to come here is need. There’s no paperwork. There’s no qualification, and what’s dispensed here is not as much care as it is Love and dignity for a fellow human being.”

The Mission of Mercy Story

First born of a whispered thought in 1991, Mission of Mercy medical clinics came to be through devout Catholic and Arizona native, Gianna Talone-Sullivan, who was also a practicing pharmacist.